Article by Mike Freier

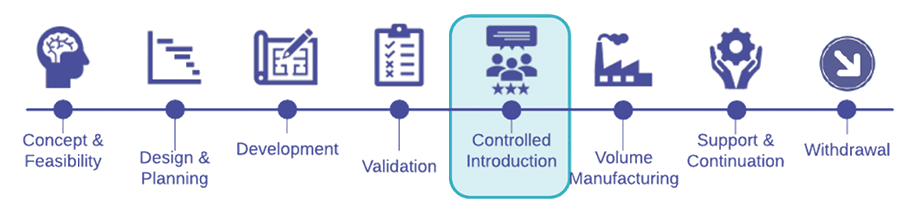

In the last blog post, we discussed how to validate your product and cover some of the important testing that your engineering teams should plan on to ensure your product meets all the requirements outlined in the engineering design specification.

Transitioning from engineering and beta units to high volume production involves finding a contract manufacturer (CM) as well as sub-tier volume suppliers, signing a deal with the CM, and handing off the set of data and instructions to make your product. Read on to learn what to lookout for in each step in the process of scaling your product into volume manufacturing.

Contract Manufacturer Selection

The first step in this process is to select a CM that best matches your product and production requirements. There are a large number of CMs with different capabilities, factory locations and product expertise. Most established companies have established relationships with CM’s and sub-tier suppliers that they are already working withiHowever, if you’re new to the field, it is recommended to hire an experienced consultant, that has deep history in this area to help you navigate the myriad of options, and to find the best fit for your business needs.

Recognizing there are a large number of CMs that manufacture a wide range of products for different markets, consider how the tradeoffs may impact your business.

Costs and Trade-Offs

Original Equipment Manufacturer versus Contract Manufacturer control of tooling development

Contract manufacturers will offer to oversee the tool development (usually multiple stages) and final piece part quality for a material overhead fee. Generally, the CM material overhead rate is higher in the US (12-20%) than offshore (3%-8%).

PRG recommends that original equipment manufacturers (OEMs) maintain direct control over the tool development and part acceptance process until completion. This is because it ensures the communication flows smoothly between supplier and OEM design and manufacturing team about the tooling and part trade-offs (pricing versus quality).

Once part approval is achieved, then the OEM can add the mechanical part to the CM bill of manufacturing for handling. This step usually entails generating a letter to the supplier allowing the CM to purchase parts based on OEM’s contract terms.

While this is a great option for many companies, it’s equally important for the OEM to maintain control over the tool development and part acceptance process until completion. Further, there needs to be regular and clear communication between the CM and OEM design and manufacturing teams to ensure the design of the tool and final part trade-offs (e.g. cost versus quality) meets the OEM standards.

Offshore versus USA

Related to costs, offshore tooling can be significantly lower than USA suppliers. In some cases, we have seen up to a 5:1 difference in tooling fees, depending on the region of the world. So, that’s great news for OEMs who want lower part costs + higher margins. But, before you commit to working with a CM half-way around the globe, consider the additional cost of international travel, shipping, etc.

Non-Recurring Engineering (NRE) Costs

Contract Manufactures typically charge 50% NRE up-front and invoice the remaining 50% on delivery. Some suppliers will offer to amortize the NRE over the first year production parts to help offset the up costs, which can help with cash-flow, but result in higher unit Cost of Goods Sold (COGS). It’s best if you start a conversation with your CM early, so you can understand how NRE affects your cost model and schedule.

——————————————————

Control of Tooling Development: Costs and Trade-Offs

There are trade-offs associated with Original Equipment Manufacturers (OEMs) and CMs in the development of hard tooling for parts. See below for some key factors to consider.

Offshore vs Local (USA)

Offshore tooling costs can be significantly lower than those in the USA, with up to a 5:1 difference in toolmaker fees depending on the region. This can result in lower part costs and higher margins. However, additional costs such as international travel and shipping should also be considered before committing to an offshore tooling supplier. In addition to these factors, it is essential to consider the geopolitical risks associated with doing business in China. These risks can include trade disputes, political tensions, intellectual property concerns, and regulatory changes.

Direct Control by OEM

OEMs maintaining direct control over tool development and part acceptance can lead to smoother communication and better understanding of pricing and quality. This control ensures that the design of the tool and final part meets standards, and is the approach recommended by PRG.

Transfer of Control

Once part approval is achieved, the mechanical part can be added to the CM’s bill of manufacturing for handling. This step usually involves issuing a letter to the supplier that allows the CM to purchase parts based on the OEM’s contract terms.

Non-Recurring Engineering (NRE) Costs

Contract manufacturers typically charge 50% of the NRE costs upfront and invoice the remaining 50% upon delivery of hard tooling. Some CMs may offer to amortize the NRE costs over the first year of production parts, which can improve cash flow but will also result in a higher unit Cost of Goods Sold (COGS). Engaging in early discussions with your CM can help you understand how NRE costs impact your cost model and schedule.

In summary, maintaining direct control over tooling development and part acceptance by the OEM has its advantages, including better communication and a more comprehensive understanding of trade-offs. However, working with a CM can also offer cost savings and the benefit of their expertise. Careful consideration of factors such as material overhead costs, offshore vs. domestic production, and non-recurring engineering costs can help you make an informed decision on the best approach for your product and business.

————————————————————

Contract Negotiation

Once you have selected a CM, the next step in this process is to negotiate and sign a contract. A well written contract should include the following information:

- Unit pricing with volume discounts

- Tooling and NRE charges

- Lead time

- Warranty policy (credit for returned parts)

- Forecasting and flex fences

- Excess and obsolete material

- Payment terms

- Process improvement / Quality

- Termination

Focus on the critical business issues that impact your product builds and shipments.

- Supply Chain Management

- Forecasts

- Purchase Orders

- Reschedules

- Cancellations

- Pricing

- Quality

- Acceptance Criteria

- Change Management + Material Disposition

- Warranty

- Contract length + termination

In parallel, let your legal department cover IP protection, indemnification, confidentiality, and any language to ensure your contract is clear and compliant with your state’s regulations.

Equally important, make a list of all of the OEM deliverables contained in the Manufacturing Service Agreement (MSA) to ensure there is an internal process to support what you have agreed to.

Sample deliverables include:

- Publish Monthly Rolling Production Forecast

- Release of Purchase Orders/Material Management Review

- Document Product Specifications/Change Control Management

- CM Program Management Review

If you work for a startup, it’s particularly important to assign resources and focus on these deliverables, to ensure that your CM relationship is successful for both you and the CM. A consultant can help manage the relationship with the CM.

Production Handoff

Now that you have a formal contract in place, it’s time to hand off your design package to production. A complete design package should contain all the information and documentation for your CM to source components, fabricate parts, assemble each module, and test the final assembly.

Design package components

- Bill of materials

- Mechanical drawings

- PC-board layout files

- Assembly drawings

- High resolution artwork

- Quality documents and procedures

- Test procedures with pass/fail criteria

- Final test criteria

Ideally, this information is provided in digital or electronic format, so your CM can import all data into their Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES). Don’t forget to include hardware design changes or software bug fixes into the design package that surfaced during your beta program.

Production Tooling Trade-offs

- Cosmetic (e.g. color, finish, material grades, etc.)

- Critical dimensions

Once a part has been approved, the OEM should add the mechanical part to the BOM for handling. This usually entails generating a letter to the supplier allowing the CM to purchase a part based on OEMs contract terms.

Just like any relationship, the key to working successfully with your CM are shared expectations and clear communication. Once you successfully complete the controlled introduction process, your products will be flying off the assembly line in a seamless, scalable process.

About the Author

Mike Freier is a Founder and Principal Consultant at the Product Management Consulting Group Inc. He has 20+ years of experience with high-tech companies, including more than a decade in product management and product marketing. He was a long-time board member and President of the Silicon Valley Product Management Association, served on the MIT-Stanford (VLAB) executive planning committee and spent several years mentoring start-up founders at the Cleantech Open. Mike graduated from the University of Massachusetts at Amherst with a BSME degree.

Ask a question or send along a comment.

Please login to view and use the contact form.

Ask a question or send along a comment.

Please login to view and use the contact form.

Leave a Reply