Quantitative and qualitative risk analyses are two fundamental approaches in risk management, each with its distinct advantages, limitations, and applicability to different scenarios, especially in the context of product development

Quantitative Risk Analysis

Advantages:

– Objective Assessment: Quantitative risk analysis provides a numerical basis for evaluating risks, making the assessment more objective and less prone to personal biases.

– In-depth Information: It offers detailed information about the potential impact of risks, allowing for more effective mitigation strategies.

– Confidence Among Clients: A data-driven approach can increase clients’ confidence in decision-making by quantifying risks.

– Better Decision-Making: Utilizing statistical models and data analysis techniques enables more strategic and informed decisions.

Limitations:

– Data Requirement: A significant challenge is the need for high-quality data, which may not always be available or may be costly to obtain.

– Complexity and Expertise: The process can be complex, requiring specialized software and expertise, which may not be readily available.

– Spurious Precision and Credibility: Outputs may suggest a degree of precision or credibility that is not justified by the input data, potentially misleading stakeholders.

Preferred Scenarios:

Quantitative risk analysis is particularly useful in large, complex projects or when dealing with significant financial implications. It is preferred when precise risk quantification is necessary for critical decision-making, such as in projects with high investment costs or where the financial impact of risks must be accurately assessed.

Qualitative Risk Analysis

Advantages:

– Simplicity and Speed: Qualitative analysis is simpler and faster to conduct, requiring less specialized knowledge and data.

– Prioritization of Risks: It helps in prioritizing risks based on their likelihood and impact, focusing attention on the most significant threats.

– Improved Understanding: Offers a better understanding of risks by exploring their nature and potential impact without relying on numerical data.

Limitations:

– Subjectivity: The analysis is more subjective and can be influenced by the assessors’ biases and perceptions.

– Lack of Precision: Without numerical data, the analysis may not provide the precision required for some decision-making processes.

– Limited Scope: May not capture all potential risks or accurately assess their severity due to its reliance on qualitative data.

Preferred Scenarios:

Qualitative risk analysis is preferred in the early stages of product development when detailed data may not be available, and the goal is to identify and prioritize risks quickly. It is also suitable for smaller projects or when the project team needs to make rapid decisions based on a general understanding of the risks involved.

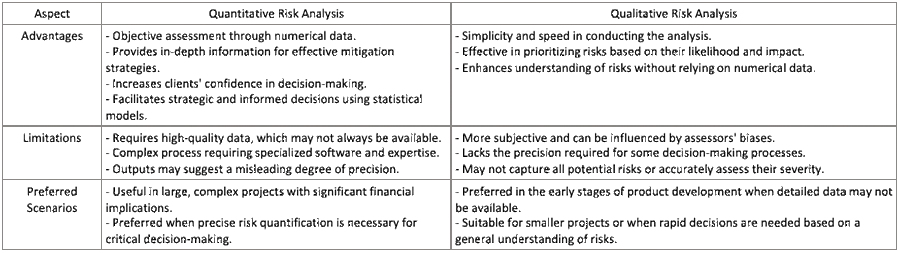

This table provides a clear comparison between quantitative and qualitative risk analysis methods in product development, highlighting their respective strengths, weaknesses, and applicability to different scenarios.

The choice between quantitative and qualitative risk analysis in product development depends on the project’s complexity, the availability of data, and the specific needs of the decision-making process. Quantitative analysis is preferred for its precision and depth in scenarios with significant financial stakes or where detailed risk quantification is essential. In contrast, qualitative analysis is favored for its simplicity and speed, particularly in the early stages of a project or when detailed data is not available. Often, a combined approach, leveraging the strengths of both methods, provides the most comprehensive risk assessment and management strategy.

Ask a question or send along a comment.

Please login to view and use the contact form.

Ask a question or send along a comment.

Please login to view and use the contact form.

Leave a Reply